Increased Buyer Activity Signals Boost in Confidence After OCR Drop and Falling Interest Rates

The recent drop in the Official Cash Rate (OCR) in August, the first in four years, appears to have positively impacted buyer confidence in the property market. Data from realestate.co.nz reveals a noticeable increase in activity within the first two weeks following the OCR announcement, compared to the two weeks prior. Residential listing inquiries rose by 8.5%, saved properties increased by 5.5%, and there was a 6.2% uptick in people saving searches to be notified about new listings.

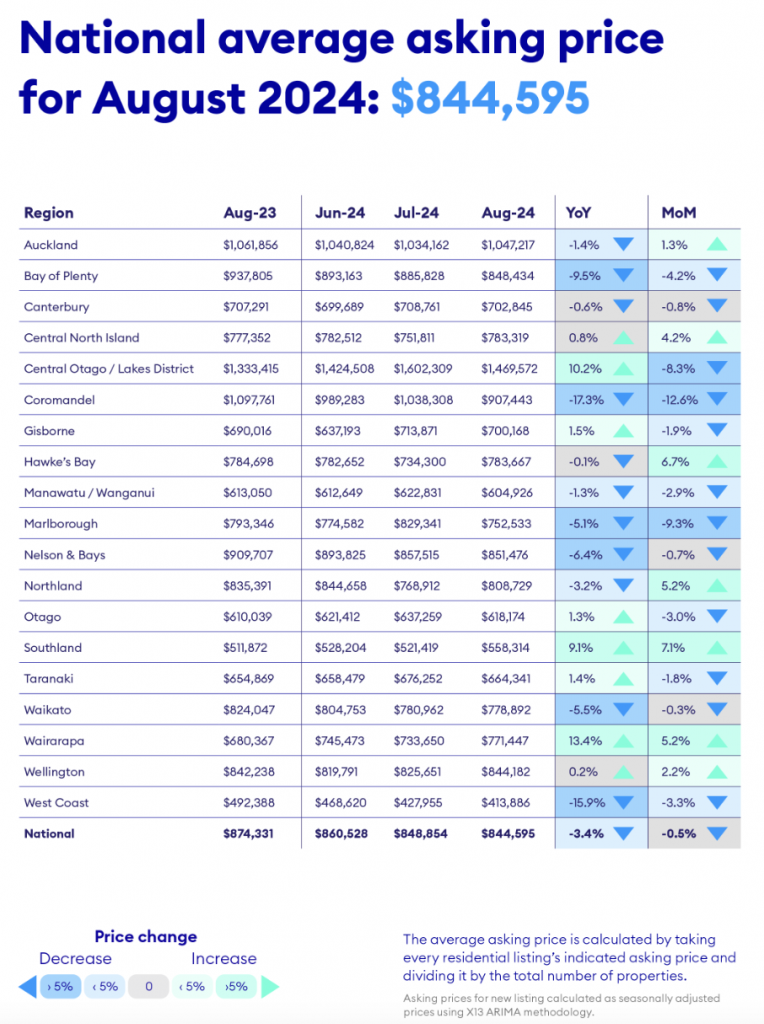

Despite the national average asking price dipping to $844,595 in August, the lowest in three and a half years, this decrease is minimal—a 0.5% drop from July and a 3.4% decline from August 2023. August also saw a return to seasonal listing trends, with new listings up 8.1% year-on-year, reflecting a resurgence in vendor confidence. Historically, August sees a rise in new listings, but this trend had been absent since 2020. The return of this seasonal pattern suggests we may be entering a new market phase.

In August, 16 out of 19 regions experienced an increase in new listings, with only Nelson & Bays, Northland, and Coromandel seeing decreases of 18.1%, 11.1%, and 5.9%, respectively.

Stock Levels Soften, Indicating Potential Market Shift

The increase in new listings resulted in a 30.0% year-on-year rise in national stock levels in August. However, stock levels fell below 30,000 homes for the first time in six months. Listings on the market for less than 30 days also rose by 11.6% compared to July, indicating that properties are moving faster. While there is still sufficient stock to maintain market stability, these trends could signal an impending shift.

Last month, 18 of 19 regions saw double-digit stock growth year-on-year, with the Bay of Plenty being the only exception, where stock remained relatively flat, increasing by just 0.7%.

Regional Price Trends: Southland Reaches New Peak

The national average asking price declined slightly, continuing a trend of flat prices, but Southland bucked this trend by hitting a new record high of $558,314—a 17-year peak. Southland and Wairarapa were the only regions to see both month-on-month and year-on-year price growth. Southland’s prices rose by 7.1% month-on-month and 9.1% year-on-year, while Wairarapa saw increases of 5.2% and 14.4%, respectively.

In contrast, regions like Bay of Plenty, Coromandel, Manawatu/Whanganui, Marlborough, and West Coast experienced declines in average asking prices. Meanwhile, Auckland saw a slight month-on-month increase in its average asking price for the first time since April, potentially signaling a shift in market dynamics for the region.

Let us help!

If you’re considering buying or selling a property and seeking to understand the current market conditions, why not chat with one of our friendly agents to understand how we can help?

Or feel free to click here to get your instant property estimate.